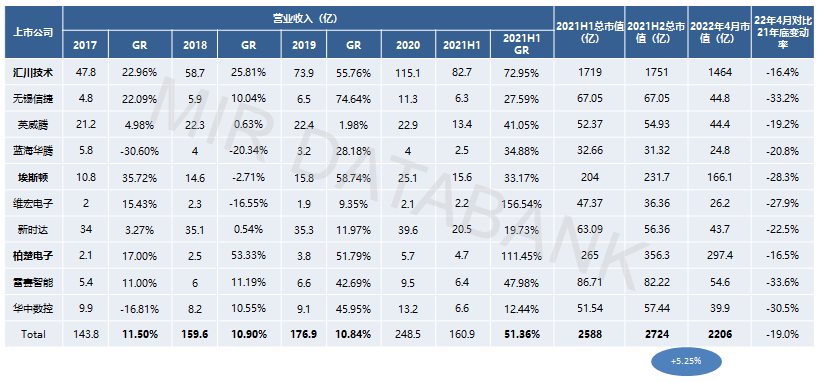

The capital market has always been the most sensitive, quick, and advanced. Judging from the revenue and market value performance of China’s top 10 domestic automation listed companies in the past two years, it can be clearly seen the market changes in the past two years and recent years.

In the first half of 2021, the automation market grew rapidly, and the market value of the top 10 listed companies reached 258.8 billion, an increase of 51.36% compared to the end of 2020. In the second half of 2021, the growth rate of the automation market will slow down. By the end of 2021, the market value of the top 10 automation listed companies will reach 272.4 billion, an increase of only 5.25% compared with the first half of 2021. Entering 2022, the downward pressure on the automation market has increased. At the end of April, the market value of the top 10 automation listed companies reached 220.6 billion, a drop of 19%, and the market value decreased by 51.8 billion.

Of course, the volatility of the capital market is also related to the global interest rate hike and the strengthening of the U.S. dollar. However, the ups and downs of the capital market in the automation field also show that the current automation market has entered a critical period of adjustment after the rapid growth of the previous few years. What is the trend of the automation market in 2022, the capital market, like everyone else, more or less feels the risk of market downturn.

In 2022, the turning point of the three-year cycle of the automation market?

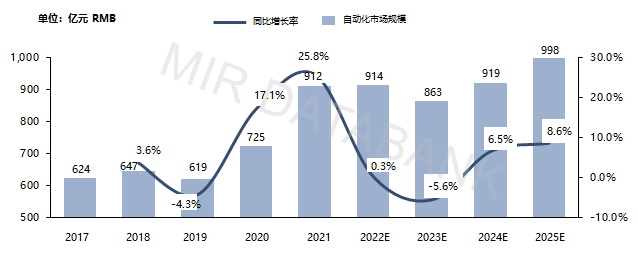

In the past ten years, the automation market has been relatively cyclical. 2011, 2014, and 2017 were all years of rapid growth in the automation market. Among them, 2017 was closely related to the promotion of the national smart manufacturing 2025 policy, the year of Apple’s investment, and the rapid outbreak of new energy lithium batteries.

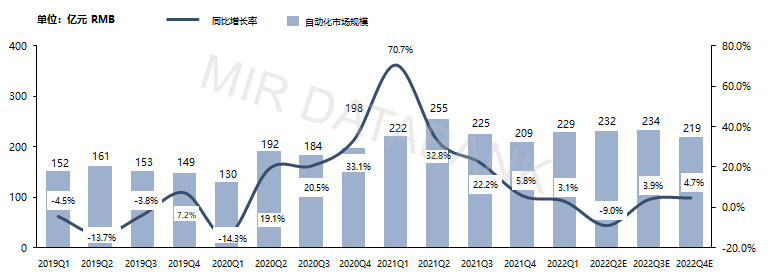

In 2022, the growth rate of the automation market will slow down. Does this herald the end of this cycle of rapid growth in the automation market? Will 2023 reach the trough of this cycle, and will the automation market usher in a cyclical decline? In 2024 and 2025, will China’s automation market start a new round of growth cycle as scheduled? At present, according to the observation of MIR Rui Industry, in 2022 and the next three years, China’s automation market will most likely develop according to the above logic.

In early 2022, Elon Musk tweeted a relatively pessimistic view on the economic situation in 2022: “Predicting the macro economy is challenging, my gut feeling is that the Great Recession will be around the spring or summer of 2022, But not later than 2023”.

Macroeconomic downturn

According to data released by the Service Industry Survey Center of the National Bureau of Statistics and China Federation of Logistics and Purchasing on April 30, in April, the manufacturing purchasing managers’ index (PMI) was 47.4%, down 2.1 percentage points from the previous month. In April, China’s manufacturing purchasing managers’ index (PMI) was the lowest since March 2020, and the downward pressure on the manufacturing industry has increased. The production index was 44.4 percent, a decrease of 5.1 percentage points from the previous month, and the manufacturing production activity slowed down significantly. The new orders index was 42.6 percent, a decrease of 6.2 percentage points from the previous month, and the demand in the manufacturing market fell sharply.

In addition, data from the General Administration of Customs shows that from the perspective of a single month in April, China’s total import and export value in US dollars was 496.12 billion US dollars, a year-on-year increase of 2.1%. Among them, the export was 273.62 billion US dollars, a year-on-year increase of 3.9%. The global epidemic continues to improve, and manufacturing orders are returning to Europe, America and Southeast Asia, which has a relatively obvious impact on domestic manufacturing and automation demand.

In the first quarter of 2022, the year-on-year GDP growth rate was 4.8%, of which the year-on-year growth rate of infrastructure investment reached 8.5%.

Downstream industry demand declines

In 2022, the downstream industry will face great downward pressure, and the three fields of new energy, automation improvement and infrastructure will become relatively stable growth points of the market.

Industries affected by cyclicality

The electronics and machine tool industries are currently in an industry down cycle. Taking the electronics industry as an example, the development of 5G in 2022 will not be as good as expected, the shipment of mobile phones will drop significantly, and Apple will invest less in a small year. The automation demand of the 3C industry will face greater downward pressure in 2022.

Industries affected by declining investment in infrastructure sectors such as real estate

Elevators, construction machinery, cranes and other industries are directly related to infrastructure. In 2022, leading real estate companies will experience thunderstorms one after another, real estate investment will decrease, and infrastructure projects will be delayed or slowed down due to the closure and control of the epidemic. Taking construction machinery as an example, 24,534 excavators of various types were sold in April, a year-on-year decrease of 47.3%, and 10,975 loaders of various types were sold in April, a year-on-year decrease of 40.2%. The sales of the entire infrastructure-related machinery industry declined significantly.

Industries affected by manufacturing outflows from China

Textiles, rubber tires, plastics and other industries are greatly affected. On the one hand, the implementation of the double-anti-reverse policy for tires continues, and domestic companies build factories in Southeast Asia and other raw materials to avoid trade risks. On the other hand, since 2021, Vietnam and other countries have been opening up more and actively integrating into the world economy. With the signing of various trade agreements, Vietnam’s exports have ushered in a new round of high-speed growth, with orders for toys, clothing, electronics, etc. The trend of transfer in countries such as Vietnam is becoming more and more obvious. In addition, the shutdown of factories such as Apple Foxconn due to the closure and control of the epidemic in China has a greater impact, which has accelerated the process of investment in India, Malaysia and other places.

Industries affected by sluggish consumption of internal circulation

The strong downward pressure on the economy, frequent layoffs in various industries, continued rise in domestic oil prices, high inflation pressure, and epidemic lockdowns have added a lot of pressure to the expansion of the domestic consumer market. Weak growth in 2022.

Above, the automation market will be under great downward pressure in Q2 2022, and the automation market may experience negative growth for the first time in 8 quarters.

In the past two years, the localization of the automation market has achieved good results, especially in the field of servo, the domestic progress is particularly obvious. With the rapid improvement of localization, local automation companies have done outstanding work in the following four aspects.

- Keep up with national strategies such as carbon neutrality and advanced manufacturing, and focus on new energy lithium batteries, photovoltaics and other industries.

- In terms of marketing mode, the marketing concept of local companies is more in line with market needs. Marketing philosophy of foreign companies: I can buy whatever customers I have; Marketing philosophy of local companies: I will sell whatever customers need.

- In terms of supply chain, local companies should be more flexible.

- The product research and development of local companies closely follows the market demand, and the product iteration speed is fast and the effect is good.

Although China’s automation market is under relatively large downward pressure in the first half of 2022, the market growth rate will slow down significantly in 2022, and there may even be negative growth in 2023, but we are still very optimistic about the future development prospects of China’s automation market. With the continuous upgrading of China’s industry and the continuous improvement of automation level, foreign and domestic automation companies in China will also usher in more development opportunities.